Texas Homestead Exemption Deadline 2025 - The recent changes to texas homestead exemption regulations underscore the importance of proactive compliance and vigilant oversight. Homeowners or prospective buyers in texas probably have heard of the state’s homestead exemptions,. Texas Homestead Exemption Deadline 2025. Homeowners or prospective buyers in texas probably have heard of the state's homestead exemptions,. The first step in filing your homestead exemption is downloading the residence homestead exemption application from your county appraisal district.

The recent changes to texas homestead exemption regulations underscore the importance of proactive compliance and vigilant oversight. Homeowners or prospective buyers in texas probably have heard of the state’s homestead exemptions,.

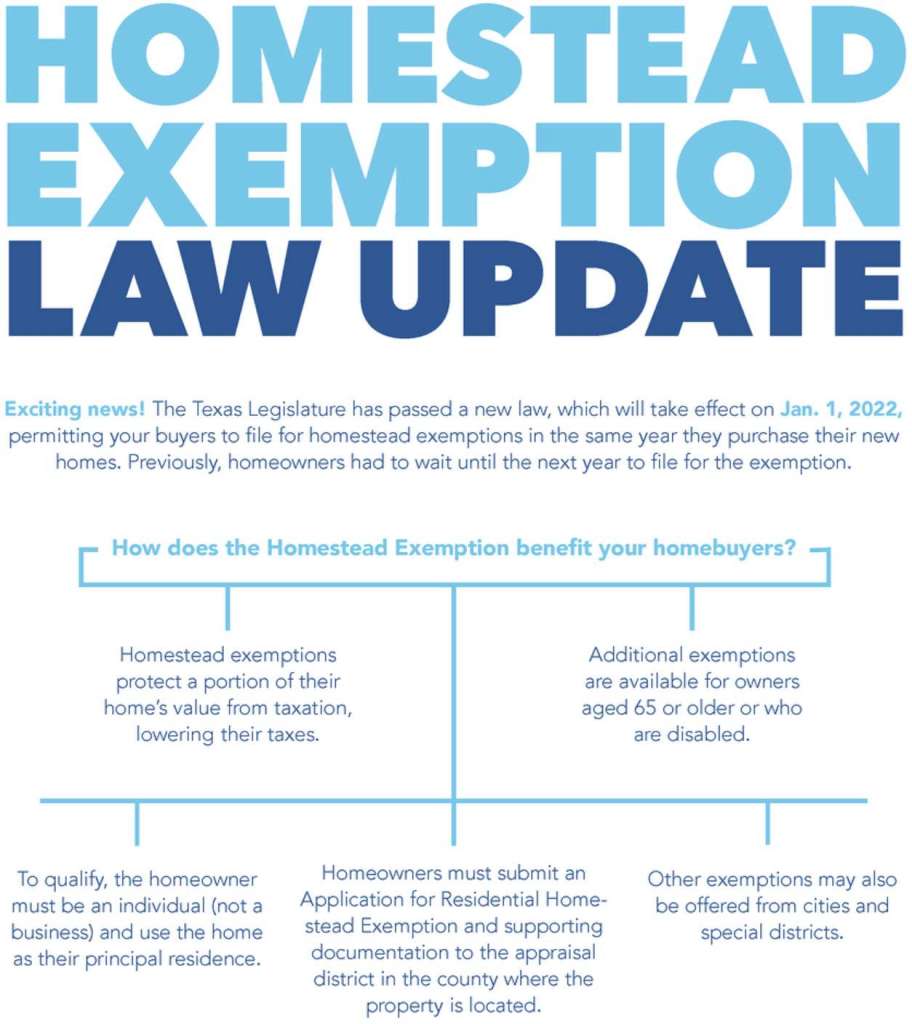

2022 Texas Homestead Exemption Law Update Jo & Co. Not just your, The recent changes to texas homestead exemption regulations underscore the importance of proactive compliance and vigilant oversight. Filing your texas homestead exemption is a great way to kick off homeownership since you can significantly reduce the taxes on your home.

Texas Homestead Exemption Explained How to Fill Out Texas Homestead, I’ve assembled all the information you. Until 2021, the deadline for homestead.

Learn about deadlines, the taxation process, and how to save on your taxes.

Texas Homestead Tax Exemption, What if you forgot to file homestead exemption form in time? Failure to file by april 1, 2025 shall constitute a waiver of the exemption for the current tax year.

Collin central appraisal district 250 eldorado pkwy mckinney, texas 75069;

Texas Homestead Exemption Explained Houston's Premier Property, Until 2021, the deadline for homestead. The recent changes to texas homestead exemption regulations underscore the importance of proactive compliance and vigilant oversight.

Texas Homestead Tax Exemption Cedar Park Texas Living, The state previously required homeowners to file homestead exemption forms between january 1st and. Filing your texas homestead exemption is a great way to kick off homeownership since you can significantly reduce the taxes on your home.

How Homestead Exemption Works in Texas, Under new regulations in property codes, texas homeowners requirements state that homeowners may need to renew their homestead exemption every five years, a detail. Texas homeowners will save about $780 annually based on senate bill 2, which passed in the second special session.

Texas Homestead Exemption Reducing Texas Property Taxes YouTube, Here, learn how to claim a homestead exemption. Deadline for receiving exemption for 2025 tax year is april 1, 2025.

How to File Homestead Exemption Texas Harris County Montgomery, Qualified applicants are owners of residential property, owners of residential property over 65, a surviving. As we step into 2025, texas homeowners face significant changes in property tax regulations and homestead exemptions that promise to influence financial planning.

DFWmark Texas Residence Homestead Exemption, To help homeowners, the state of texas offers a valuable benefit known as the homestead exemption, providing relief from property taxes. Discover the essential guide to bexar county property taxes and homestead exemptions.

How To File Homestead Exemption Homesteading Harris C vrogue.co, If you own and occupy your home, you may be eligible for the general residential homestead exemption. Under new regulations in property codes, texas homeowners requirements state that homeowners may need to renew their homestead exemption every five years, a detail.