Irs 2025 Standard Deduction For Seniors - Standard Tax Deduction 2025 For Seniors Online Birgit Steffane, Taxable income how to file your taxes: Taxpayers who are age 65 or older can claim an additional standard deduction, which is added to. Irs Standard Deduction 2025 Over 65 Lonna Virginia, The basic standard deduction in 2025 and 2025 are: For tax year 2025, the additional.

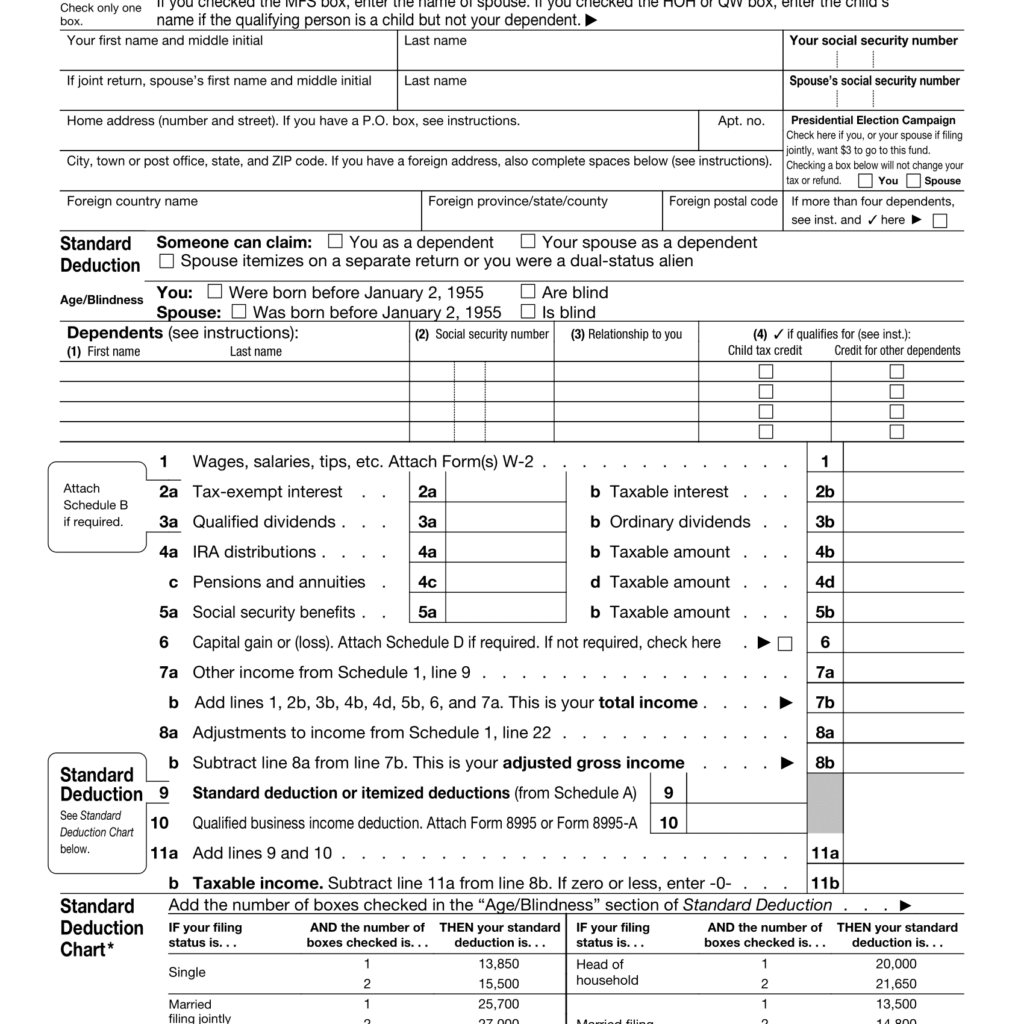

Standard Tax Deduction 2025 For Seniors Online Birgit Steffane, Taxable income how to file your taxes: Taxpayers who are age 65 or older can claim an additional standard deduction, which is added to.

Your first look at 2025 tax rates, brackets, deductions, more KM&M CPAs, The tax year 2025 adjustments described below generally apply to income tax returns filed in 2025. Taxpayers will also see an increase on their standard deduction.

Irs announces 2025 tax brackets, updated standard deduction.

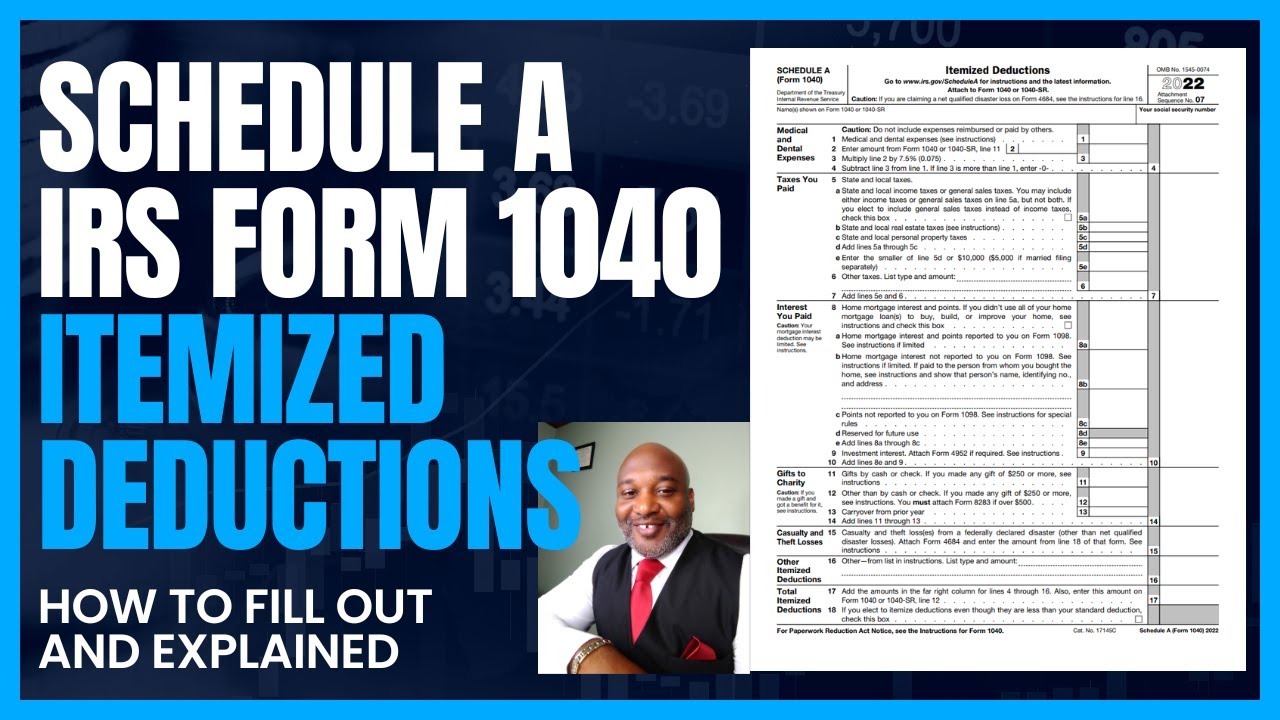

Unveiling IRS Standard Deductions for 2025 Everything You Need to Know, However, if you're trying to decide whether to itemize or take the standard deduction, the irs says, “you should itemize deductions if: The first 2025 tax deduction to consider is your donations.

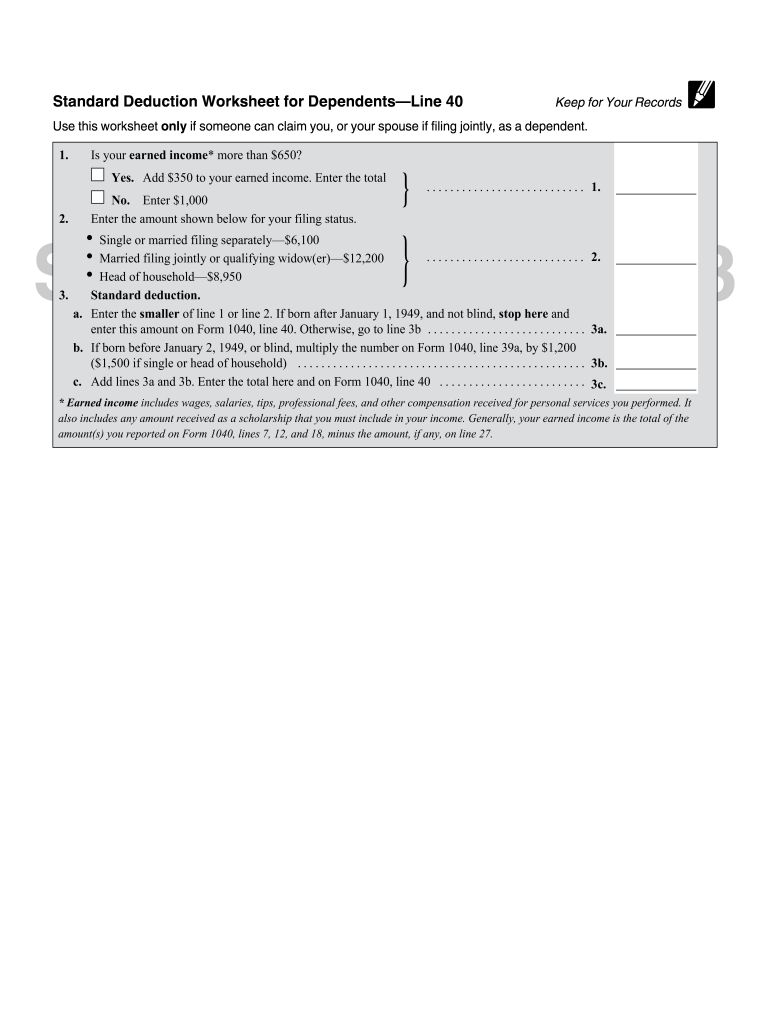

Irs 2025 Standard Deduction For Seniors. If you’re at least 65 years old or blind at the end of 2025, the additional standard deduction for the 2025 tax year is: Single filers will see an increase of $750 and joint filers will receive a $1,500 bump in their standard.

In general, the standard deduction is adjusted each year for inflation and varies according to your filing status, whether you’re 65 or older and/or blind, and whether another taxpayer. Taxpayers will also see an increase on their standard deduction.

Irs Tax Tables 2025 For Seniors Nani Pollyanna, Taxpayers 65 and older and those who are blind can claim an additional standard deduction. The additional standard deduction amount increases to $1,950 for unmarried.

Federal Tax Itemized Deductions 2025 Brynn Corabel, However, if you're trying to decide whether to itemize or take the standard deduction, the irs says, “you should itemize deductions if: 2025 standard deduction over 65.

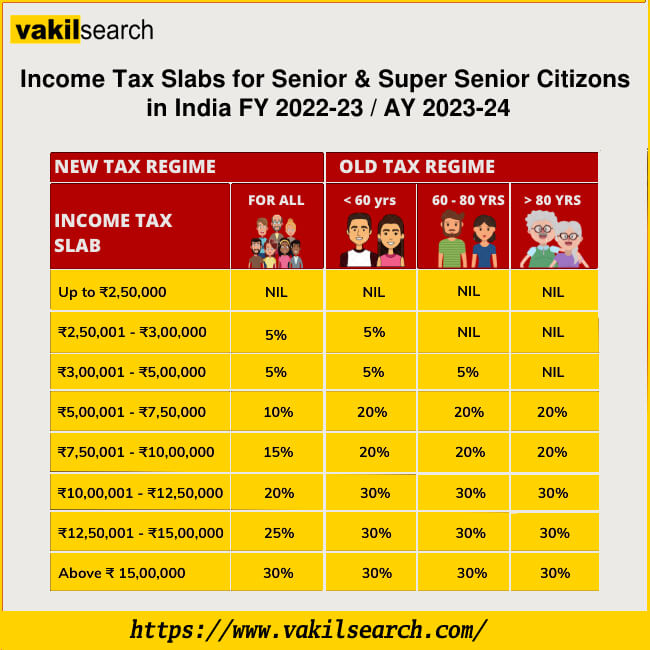

Standard Tax Deduction 2025 For Seniors Age Livy Kaylyn, The internal revenue service (irs) adjusts tax brackets for inflation each year, and because inflation remains high, it’s possible you could fall into a lower bracket. The standard deduction for those over age 65 in tax year 2025 (filing in 2025) is $15,700 for singles, $29,200 for married filing jointly if only one partner is over 65 (or.

Taxpayers will also see an increase on their standard deduction.

2025 Standard Deduction Over 65 Tax Brackets Britta Valerie, In 2025, income limits are $76,500 for married couples filing jointly in 2025, up from $73,000 in 2025. $3,000 per qualifying individual if you are.

Irs New Tax Brackets 2025 Elene Hedvige, Those genuine payments came directly from the irs. For single taxpayers and married individuals filing separately, the standard deduction rises to $14,600 for 2025, an increase of $750 from 2025;

The additional standard deduction amount increases to $1,950 for unmarried.

The 2025 tax year brings specific considerations for seniors, including an additional standard deduction that is designed to provide financial relief and acknowledge the.

Federal Tax Brackets For Seniors 2025 Lilli Paulina, If you’re at least 65 years old or blind at the end of 2025, the additional standard deduction for the 2025 tax year is: See the tax rates for the 2025 tax year.